ETH ATH: Ethereum Nears $5,000 as Institutional Demand and Fed Signals Align

Ethereum Hits Historic Highs

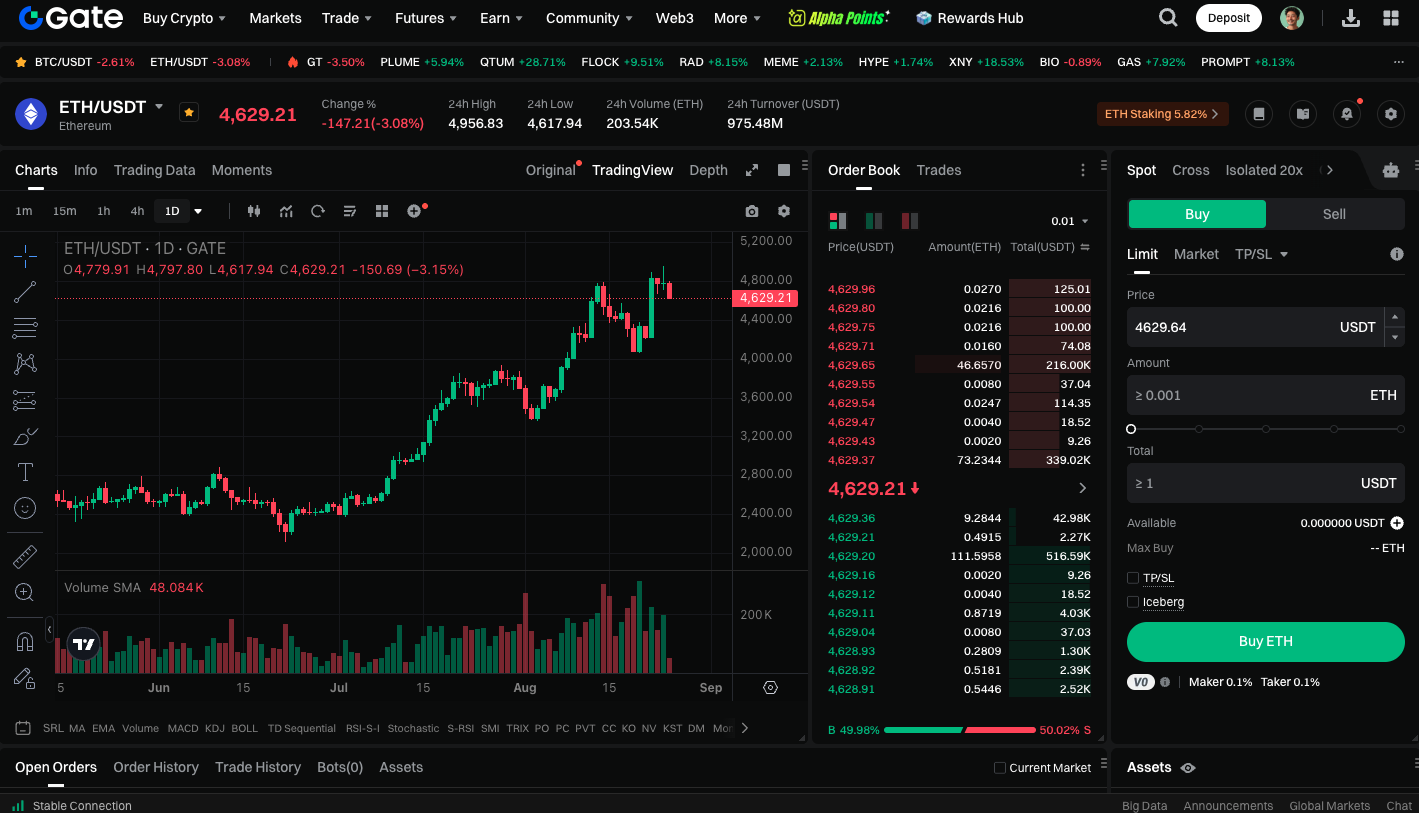

The cryptocurrency market has entered another surge, with Ethereum (ETH) reaching around $4,956 this weekend—its first all-time high (ATH) since 2021. While the price soon eased to $4,631, this rally still delivered a nearly 21% gain, positioning Ethereum as the driving force of the market rally.

Fed Signals Fuel Market Risk Appetite

Federal Reserve Chair Jerome Powell’s comments at the Jackson Hole annual symposium proved pivotal for the market. By signaling that interest rates may soon be lowered, Powell sparked immediate demand for risk assets. Both stock markets and cryptocurrencies rallied together, with ETH outpacing the broader rebound and outperforming the broader market rally.

Institutional and Fund Holdings Accelerate

This ETH all-time high occurs in a very different environment compared to 2021. Beyond supportive macroeconomic policy, institutional buying is now a key pillar for the market. Corporate treasuries and long-term funds have locked away more than 10.6 million ETH (worth over $50 billion). Bitmine Immersion Tech recently acquired $45 million in ETH, bringing its total holdings to 1.5 million ETH, now worth over $7 billion. SharpLink Gaming and Coinbase join the ranks of major holders, further reflecting that Ethereum has entered a phase of institutional accumulation.

Analyst Views

Riya Sehgal, an analyst at Delta Exchange, notes that although short-term momentum has cooled, ETH is currently testing support in the $4,680 to $4,700 zone. The medium-term outlook remains robust, with a breakthrough of the $5,000 level likely by year-end.

Wall Street veteran Tom Lee is even more bullish. He asserts that, with falling rates and the dual momentum of AI and blockchain innovation, ETH could aim for $15,000 during this cycle. Lee stresses that Ethereum’s use cases and ecosystem growth far surpass those of the previous bull market.

ETH’s Growing Connection to Traditional Finance

Further highlighting its market evolution, ETH has become increasingly correlated with traditional markets. According to Ava Labs COO Charley Cooper, when rate cuts are seen as a catalyst for crypto rallies, it’s evidence that Ethereum is now viewed as a risk asset, just as sensitive to interest rates as stocks. This shift means crypto is no longer isolated—it’s now an integral part of global financial markets.

You can start trading ETH spot instantly at: https://www.gate.com/trade/ETH_USDT

Summary

This ETH all-time high not only marks a price milestone—it highlights Ethereum’s rising prominence in institutional adoption, regulatory backing, and the broader capital markets. With the ETF boom, increased corporate reserves, and a supportive macroeconomic environment, there is broad market consensus that $5,000 is only the beginning for Ethereum’s next phase.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

What is N2: An AI-Driven Layer 2 Solution

How to Sell Pi Coin: A Beginner's Guide

Grok AI, GrokCoin & Grok: the Hype and Reality

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025