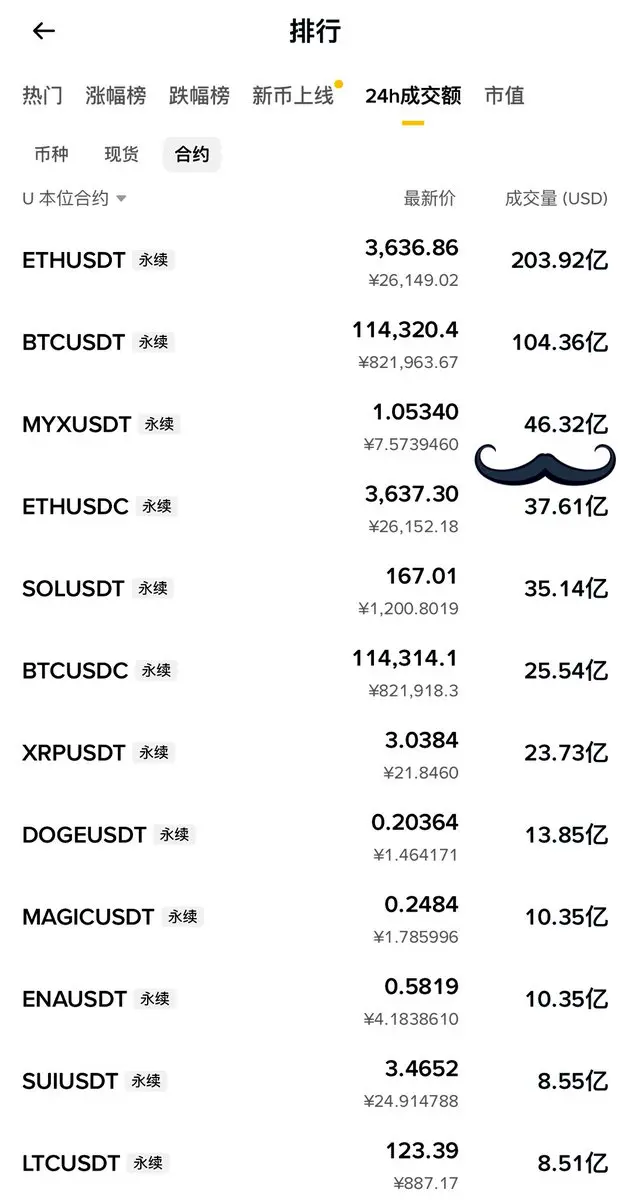

How to identify market makers controlling the market trend to avoid getting liquidated?

If you see:

1. The contract price has long been significantly deviating from the spot price ( > 0.5% )

2. The funding rate has been extremely biased in one direction for a long time (, for example, continuously for several hours at -1% or even -2% ).

3. The settlement frequency has been temporarily increased to once every hour or even more frequently (.

Then it's highly likely that the market maker is intentionally maintaining the decoupling:

▪️Price deviation → leads to extreme funding fees

▪️High-frequenc

View OriginalIf you see:

1. The contract price has long been significantly deviating from the spot price ( > 0.5% )

2. The funding rate has been extremely biased in one direction for a long time (, for example, continuously for several hours at -1% or even -2% ).

3. The settlement frequency has been temporarily increased to once every hour or even more frequently (.

Then it's highly likely that the market maker is intentionally maintaining the decoupling:

▪️Price deviation → leads to extreme funding fees

▪️High-frequenc