CoincrazeCentral

No content yet

CoincrazeCentral

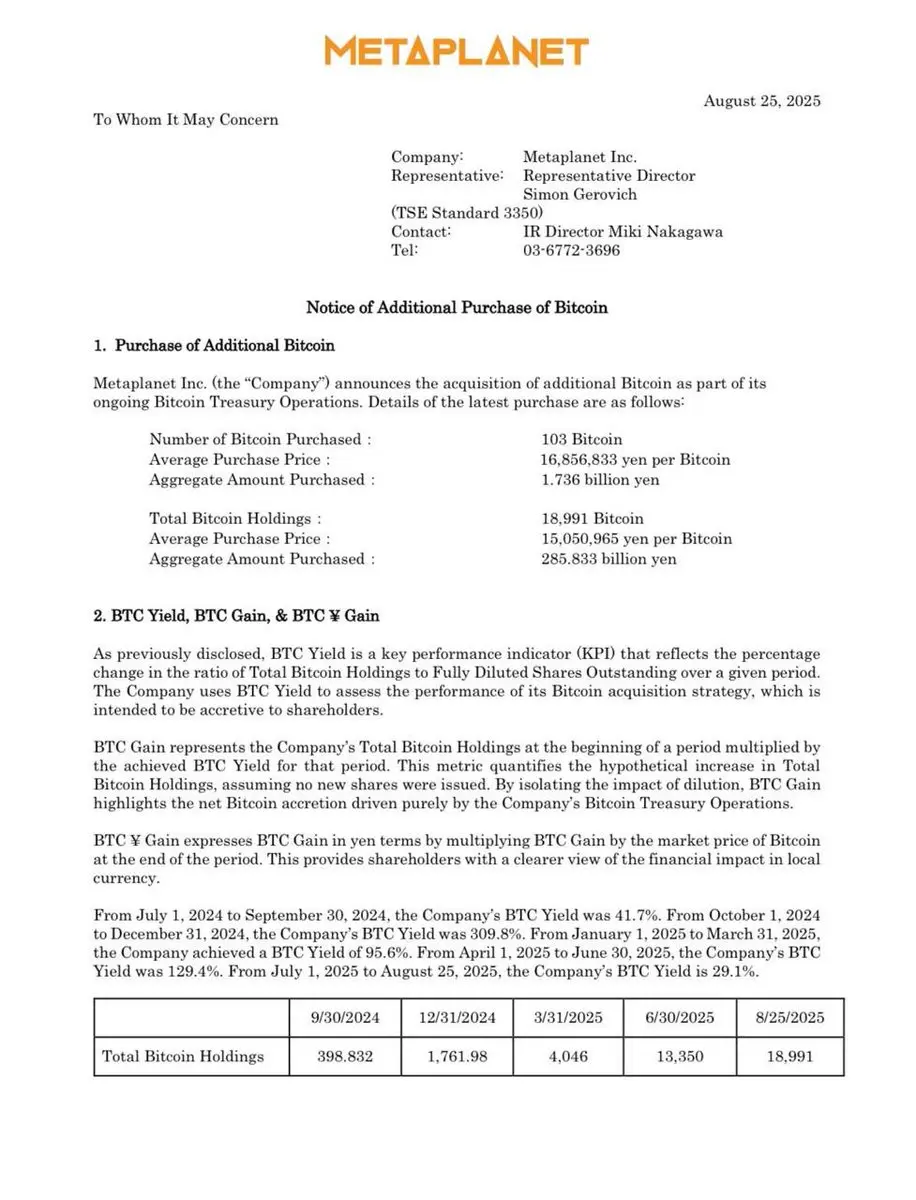

Metaplanet Adds 103 BTC, Total Holdings Now 18,991 BTC

Tokyo-listed Metaplanet Inc. has acquired an additional 103 BTC at an average price of ¥16.86M per coin (~$116K), bringing its total Bitcoin treasury to 18,991 BTC, worth over ¥285.8 billion.

The firm is using a mix of debt repayment and strategic equity issuance to support its BTC accumulation. Recently, it approved the conversion of warrants into 4.9 million new shares at approximately ¥884/share to raise capital—part of which has been used to repay obligations early.

Importantly, additional outstanding warrants remain, signaling potenti

Tokyo-listed Metaplanet Inc. has acquired an additional 103 BTC at an average price of ¥16.86M per coin (~$116K), bringing its total Bitcoin treasury to 18,991 BTC, worth over ¥285.8 billion.

The firm is using a mix of debt repayment and strategic equity issuance to support its BTC accumulation. Recently, it approved the conversion of warrants into 4.9 million new shares at approximately ¥884/share to raise capital—part of which has been used to repay obligations early.

Importantly, additional outstanding warrants remain, signaling potenti

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Cleveland Fed’s Hammack Sees No Case for Rate Cuts Amid Persistent Inflation and Tariff Uncertainty

Cleveland Fed President Beth Hammack has pushed back against calls for rate cuts, emphasizing that inflation remains too high and is trending upward. She cautioned that current inflation data only begins to reflect the impact of tariffs—and broader pricing pressures may emerge more clearly in the coming year

Hammack highlighted that the economy is holding steady, and maintaining current rates poses limited downside risk. But she argued a cautious stance remains essential given the unpredictable

Cleveland Fed President Beth Hammack has pushed back against calls for rate cuts, emphasizing that inflation remains too high and is trending upward. She cautioned that current inflation data only begins to reflect the impact of tariffs—and broader pricing pressures may emerge more clearly in the coming year

Hammack highlighted that the economy is holding steady, and maintaining current rates poses limited downside risk. But she argued a cautious stance remains essential given the unpredictable

- Reward

- like

- Comment

- Repost

- Share

Senator Lummis Pushes Senate to Accelerate Crypto Market Structure Legislation

The Senate returns September 3.

September: The Senate Banking Committee, led by Tim Scott and digital-assets chair Cynthia Lummis, plans to mark up a comprehensive crypto market structure bill aimed for complete Senate approval by September 30.

October: The Senate Agriculture Committee will handle matters involving CFTC jurisdiction as part of the bill’s oversight allocations.

The goal is to finalize the crypto framework—including jurisdictional clarity between SEC and CFTC—and deliver it to the President’s desk bef

The Senate returns September 3.

September: The Senate Banking Committee, led by Tim Scott and digital-assets chair Cynthia Lummis, plans to mark up a comprehensive crypto market structure bill aimed for complete Senate approval by September 30.

October: The Senate Agriculture Committee will handle matters involving CFTC jurisdiction as part of the bill’s oversight allocations.

The goal is to finalize the crypto framework—including jurisdictional clarity between SEC and CFTC—and deliver it to the President’s desk bef

- Reward

- like

- Comment

- Repost

- Share

Musk Halts Ambitions for "America Party," Refocuses on Business and GOP Alliances

Elon Musk has quietly put the brakes on building his own political movement—the so-called America Party. The Wall Street Journal reports he’s stepping back from forming a third party to prioritize his business interests and preserve alliances with influential Republicans. Notably, he’s keen to avoid alienating Vice President JD Vance, whom he may potentially back in a 2028 presidential bid

This retreat seems more strategic than final: Musk hasn't entirely ruled out launching the party in the future, but his team

Elon Musk has quietly put the brakes on building his own political movement—the so-called America Party. The Wall Street Journal reports he’s stepping back from forming a third party to prioritize his business interests and preserve alliances with influential Republicans. Notably, he’s keen to avoid alienating Vice President JD Vance, whom he may potentially back in a 2028 presidential bid

This retreat seems more strategic than final: Musk hasn't entirely ruled out launching the party in the future, but his team

- Reward

- like

- Comment

- Repost

- Share

Powell Prepares to Deliver the Fed’s Most Crucial Policy Speech of the Year

On Friday, Fed Chair Jerome Powell takes center stage at the annual Jackson Hole symposium in Wyoming. Markets are intently watching for any indication that the Fed is preparing to ease policy—particularly with a rate cut expected in September.

Investors are pricing in a roughly 85% chance of a 25-basis-point cut, fueled by softening inflation signals and rising job market concerns. However, some Fed officials remain cautious, and Powell may temper these expectations—opting to reaffirm the Fed’s data-dependent stance r

On Friday, Fed Chair Jerome Powell takes center stage at the annual Jackson Hole symposium in Wyoming. Markets are intently watching for any indication that the Fed is preparing to ease policy—particularly with a rate cut expected in September.

Investors are pricing in a roughly 85% chance of a 25-basis-point cut, fueled by softening inflation signals and rising job market concerns. However, some Fed officials remain cautious, and Powell may temper these expectations—opting to reaffirm the Fed’s data-dependent stance r

- Reward

- like

- Comment

- Repost

- Share

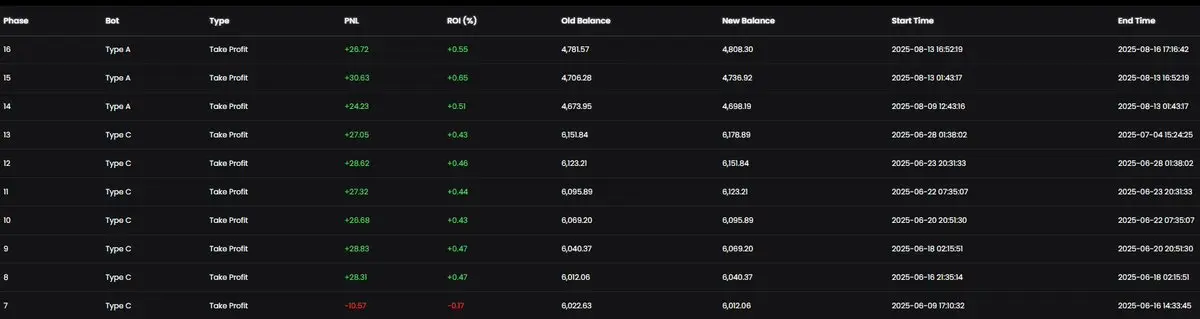

📊 Bot Performance Report

📍 UID: 2365537x

💱 Exchange: @Gate

📆 Phase: 7 → 16

🗓 Period: 2025-06-16 → 2025-08-16

Trade Summary:

✅ Profitable Trades: 9 / 10

❌ Losing Trades: 1 (Phase 7)

💰 Total Net Profit: +208.12 USDT

Key Metrics:

📊 Max ROI: +0.65% (Phase 15)

📉 Largest Loss: -10.57 USDT (Phase 7)

Despite a single dip at Phase 7, the bot rebounded strongly with consistent profits, closing 9 out of 10 trades in green. The transition from Type C → Type A further reinforced stability and compounding ROI.

📈 Performance resilience. Clean recovery. Stable growth.

📍 UID: 2365537x

💱 Exchange: @Gate

📆 Phase: 7 → 16

🗓 Period: 2025-06-16 → 2025-08-16

Trade Summary:

✅ Profitable Trades: 9 / 10

❌ Losing Trades: 1 (Phase 7)

💰 Total Net Profit: +208.12 USDT

Key Metrics:

📊 Max ROI: +0.65% (Phase 15)

📉 Largest Loss: -10.57 USDT (Phase 7)

Despite a single dip at Phase 7, the bot rebounded strongly with consistent profits, closing 9 out of 10 trades in green. The transition from Type C → Type A further reinforced stability and compounding ROI.

📈 Performance resilience. Clean recovery. Stable growth.

- Reward

- like

- Comment

- Repost

- Share

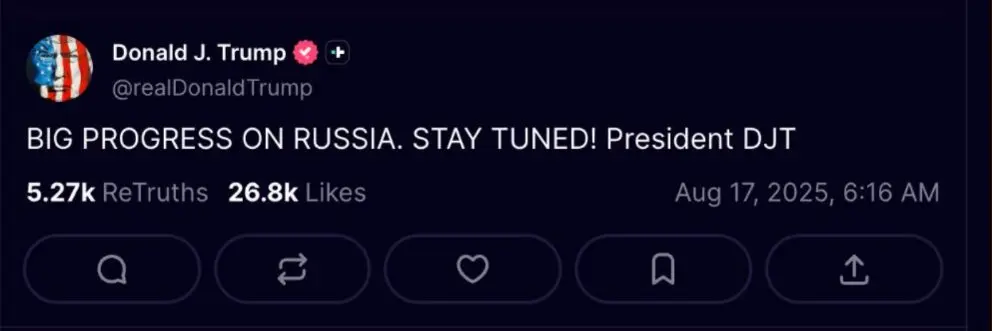

Trump Signals Imminent Breakthrough on Russia

President Donald Trump has hinted at a major development regarding Russia, stating there is “big progress” underway and urging followers to stay tuned.

While no specifics have been disclosed, markets and diplomatic circles are watching closely for potential shifts in U.S.–Russia relations—whether economic, geopolitical, or military.

The timing and tone suggest an announcement could be imminent, with significant implications for global security, energy markets, and foreign policy.

President Donald Trump has hinted at a major development regarding Russia, stating there is “big progress” underway and urging followers to stay tuned.

While no specifics have been disclosed, markets and diplomatic circles are watching closely for potential shifts in U.S.–Russia relations—whether economic, geopolitical, or military.

The timing and tone suggest an announcement could be imminent, with significant implications for global security, energy markets, and foreign policy.

- Reward

- like

- Comment

- Repost

- Share

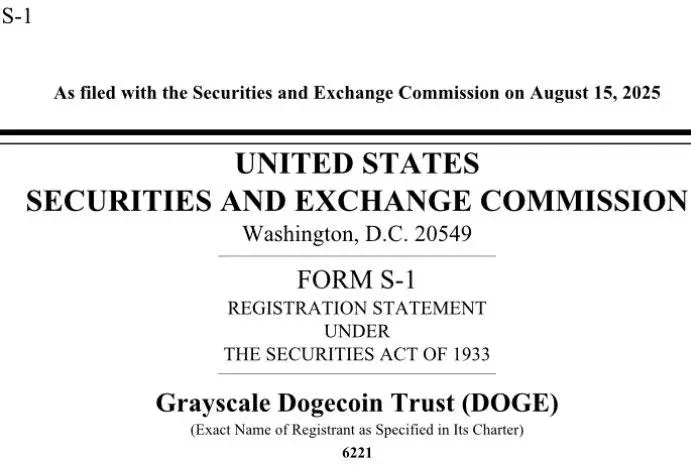

Grayscale Files S-1 Registration for Dogecoin Trust

Grayscale has officially filed an S-1 registration with the U.S. Securities and Exchange Commission to launch the Grayscale Dogecoin Trust (DOGE) as a publicly traded investment vehicle.

If approved, this would mark the first U.S.-listed investment product offering regulated exposure to Dogecoin, following the firm’s prior success with Bitcoin and Ethereum trusts.

This move reflects a broader trend: meme coins like DOGE are transitioning from speculative assets to structured products with institutional pathways. The filing date was August 15,

Grayscale has officially filed an S-1 registration with the U.S. Securities and Exchange Commission to launch the Grayscale Dogecoin Trust (DOGE) as a publicly traded investment vehicle.

If approved, this would mark the first U.S.-listed investment product offering regulated exposure to Dogecoin, following the firm’s prior success with Bitcoin and Ethereum trusts.

This move reflects a broader trend: meme coins like DOGE are transitioning from speculative assets to structured products with institutional pathways. The filing date was August 15,

- Reward

- like

- 1

- Repost

- Share

HappyBunny :

:

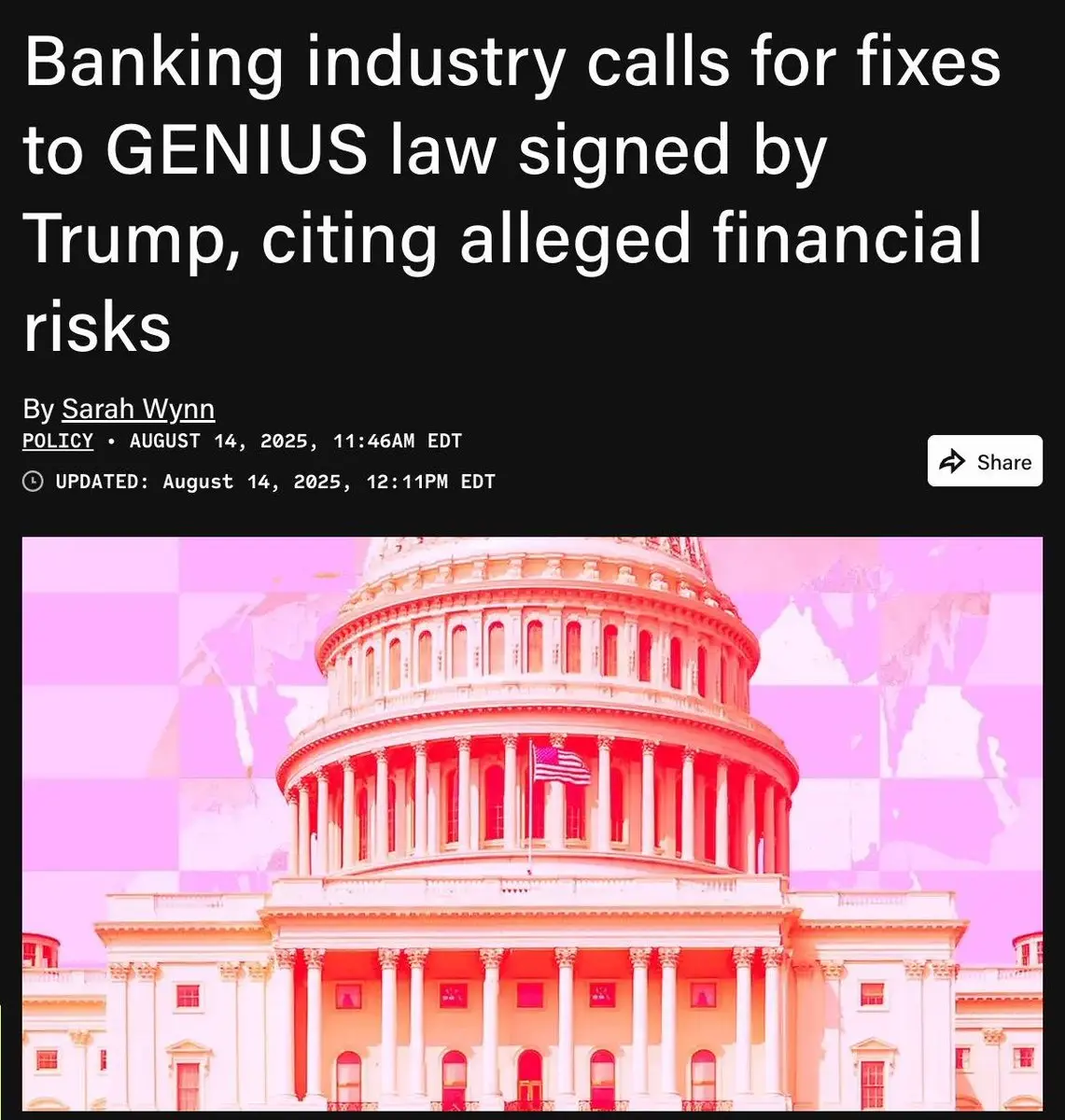

YSARB on-chain can shake out unlimited wealth possibilities for you!US Banking Groups Push to Amend Trump’s GENIUS Law Over Financial Risk Concerns

The largest U.S. banking associations—including the Bank Policy Institute, Financial Services Forum, and American Bankers Association—are calling for urgent revisions to the GENIUS Act, signed by former President Trump last month.

Industry groups warn the law introduces structural flaws that may increase deposit liquidity risks and elevate credit risk exposure across the financial system.

Concerns center on regulatory gaps and operational ambiguities that, if left unaddressed, could impact banking stability and cap

The largest U.S. banking associations—including the Bank Policy Institute, Financial Services Forum, and American Bankers Association—are calling for urgent revisions to the GENIUS Act, signed by former President Trump last month.

Industry groups warn the law introduces structural flaws that may increase deposit liquidity risks and elevate credit risk exposure across the financial system.

Concerns center on regulatory gaps and operational ambiguities that, if left unaddressed, could impact banking stability and cap

- Reward

- like

- Comment

- Repost

- Share

KindlyMD and Nakamoto Holdings Merge to Launch Public Bitcoin Treasury with a 1 Million BTC Goal

KindlyMD and Nakamoto Holdings have merged to form a publicly traded Bitcoin treasury company. The combined entity will operate under the name KindlyMD, while Nakamoto becomes a subsidiary focused on Bitcoin financial services, led by David Bailey, who is also the CEO of Bitcoin Magazine.

Key strategic objectives:

+ The company aims to accumulate 1 million BTC, positioning itself as a Bitcoin-native alternative to traditional sovereign wealth strategies.

+ It has secured $710 million through a comb

KindlyMD and Nakamoto Holdings have merged to form a publicly traded Bitcoin treasury company. The combined entity will operate under the name KindlyMD, while Nakamoto becomes a subsidiary focused on Bitcoin financial services, led by David Bailey, who is also the CEO of Bitcoin Magazine.

Key strategic objectives:

+ The company aims to accumulate 1 million BTC, positioning itself as a Bitcoin-native alternative to traditional sovereign wealth strategies.

+ It has secured $710 million through a comb

- Reward

- like

- Comment

- Repost

- Share

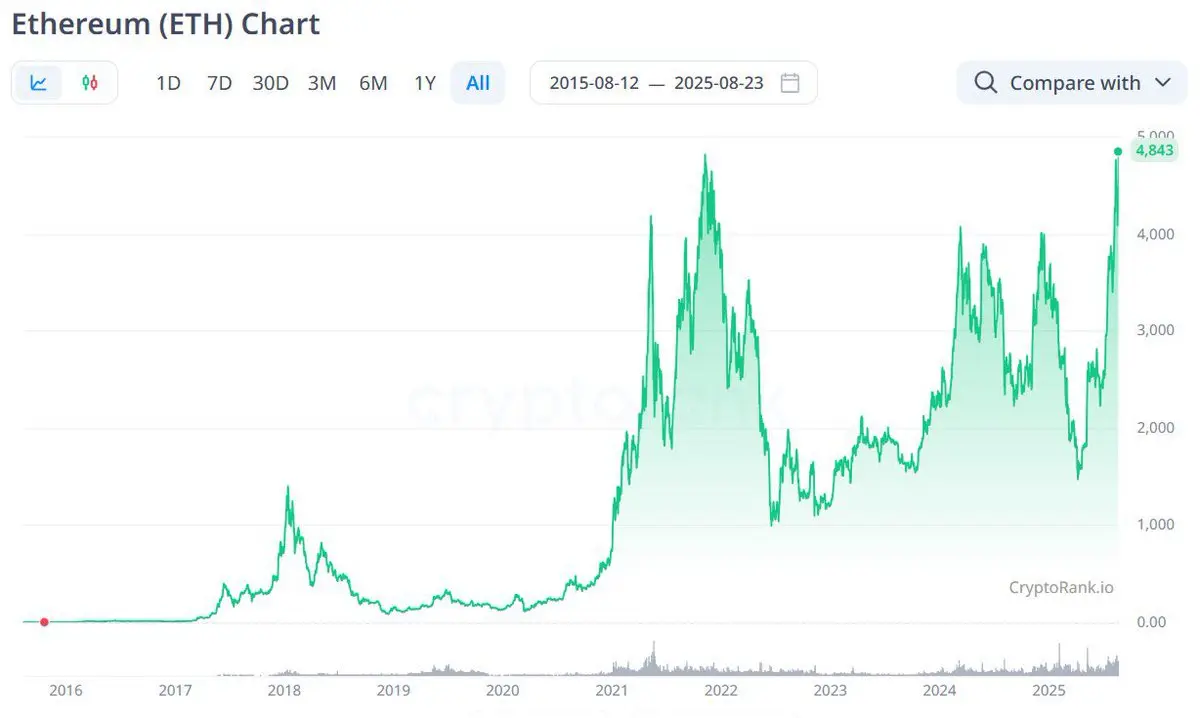

🐰ETH Rockets as Whales Join the Charge 🚀💰

⏰ 03:30 & 10:10 (UTC) – ETHUSD 5m

"🚀 Strong Buy" from 🐰Coincraze Entry + Volume 1.1 → signal confirmed strong buying pressure dominating the market.

"💰 Whale Entry" from 🐰Coincraze Central + Whale Vol → clear confirmation of big money entering the game.

When Coincraze Entry + Volume 1.1 pinpoints a strong buy and Coincraze Central + Whale Vol detects whale activity right after, the probability of a sharp price push skyrockets.

>> Experienced traders know: this is when trend + big money move perfectly in sync.

#ETH # CryptoTrading #Coincraze # Trad

⏰ 03:30 & 10:10 (UTC) – ETHUSD 5m

"🚀 Strong Buy" from 🐰Coincraze Entry + Volume 1.1 → signal confirmed strong buying pressure dominating the market.

"💰 Whale Entry" from 🐰Coincraze Central + Whale Vol → clear confirmation of big money entering the game.

When Coincraze Entry + Volume 1.1 pinpoints a strong buy and Coincraze Central + Whale Vol detects whale activity right after, the probability of a sharp price push skyrockets.

>> Experienced traders know: this is when trend + big money move perfectly in sync.

#ETH # CryptoTrading #Coincraze # Trad

- Reward

- like

- Comment

- Repost

- Share

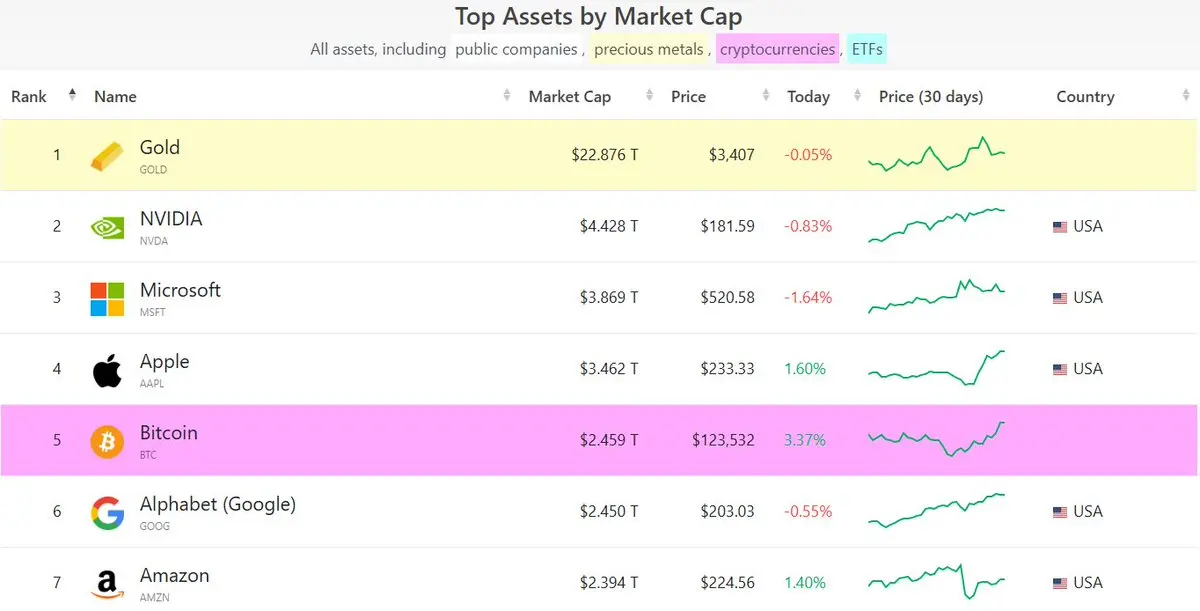

Bitcoin Overtakes Alphabet to Become the 5th Largest Asset Globally

Bitcoin has officially surpassed Google’s parent company, Alphabet, in market capitalization—now ranking as the 5th most valuable asset in the world.

Latest snapshot:

Bitcoin: $2.459 trillion

Alphabet (Google): $2.450 trillion

BTC is now trailing only behind Gold, NVIDIA, Microsoft, and Apple.

This milestone highlights a broader shift in capital markets, where decentralized digital assets are increasingly seen as macro-resilient, institutional-grade stores of value.

As Bitcoin consolidates its position alongside the world's mo

Bitcoin has officially surpassed Google’s parent company, Alphabet, in market capitalization—now ranking as the 5th most valuable asset in the world.

Latest snapshot:

Bitcoin: $2.459 trillion

Alphabet (Google): $2.450 trillion

BTC is now trailing only behind Gold, NVIDIA, Microsoft, and Apple.

This milestone highlights a broader shift in capital markets, where decentralized digital assets are increasingly seen as macro-resilient, institutional-grade stores of value.

As Bitcoin consolidates its position alongside the world's mo

- Reward

- like

- Comment

- Repost

- Share

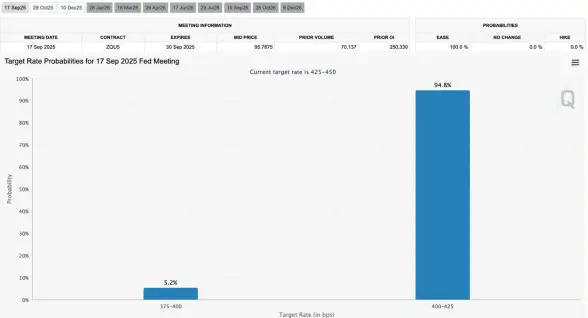

Markets Now Fully Price In a September Rate Cut

CME FedWatch Tool shows investors are assigning a 100% probability that the Federal Reserve will cut interest rates at the September 17 FOMC meeting.

Breakdown of market expectations:

+ 94.8% probability of a 25bps cut (target rate lowered to 4.00–4.25%)

+ 5.2% probability of a 50bps cut (target rate lowered to 3.75–4.00%)

The current target range stands at 4.25–4.50%. The market is no longer debating if the Fed will ease, but how much.

This pricing reflects growing consensus that inflation is softening and economic conditions may warrant more ac

CME FedWatch Tool shows investors are assigning a 100% probability that the Federal Reserve will cut interest rates at the September 17 FOMC meeting.

Breakdown of market expectations:

+ 94.8% probability of a 25bps cut (target rate lowered to 4.00–4.25%)

+ 5.2% probability of a 50bps cut (target rate lowered to 3.75–4.00%)

The current target range stands at 4.25–4.50%. The market is no longer debating if the Fed will ease, but how much.

This pricing reflects growing consensus that inflation is softening and economic conditions may warrant more ac

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Peter Thiel Quietly Bets Big on Ethereum

Peter Thiel has acquired a 7.5% stake in ETHZilla, the newly rebranded version of biotech firm 180 Life Sciences, which has pivoted to become an Ethereum treasury vehicle. The company raised $425M through a PIPE deal to accumulate ETH and position itself as a public proxy for Ethereum exposure.

This move follows Thiel and Founders Fund’s earlier acquisition of a 9.1% stake in BitMine, chaired by Tom Lee (Fundstrat). BitMine currently holds over $5B in ETH and is planning to raise an additional $20B to expand its position.

Thiel’s interest in Ethereum is

Peter Thiel has acquired a 7.5% stake in ETHZilla, the newly rebranded version of biotech firm 180 Life Sciences, which has pivoted to become an Ethereum treasury vehicle. The company raised $425M through a PIPE deal to accumulate ETH and position itself as a public proxy for Ethereum exposure.

This move follows Thiel and Founders Fund’s earlier acquisition of a 9.1% stake in BitMine, chaired by Tom Lee (Fundstrat). BitMine currently holds over $5B in ETH and is planning to raise an additional $20B to expand its position.

Thiel’s interest in Ethereum is

- Reward

- like

- Comment

- Repost

- Share

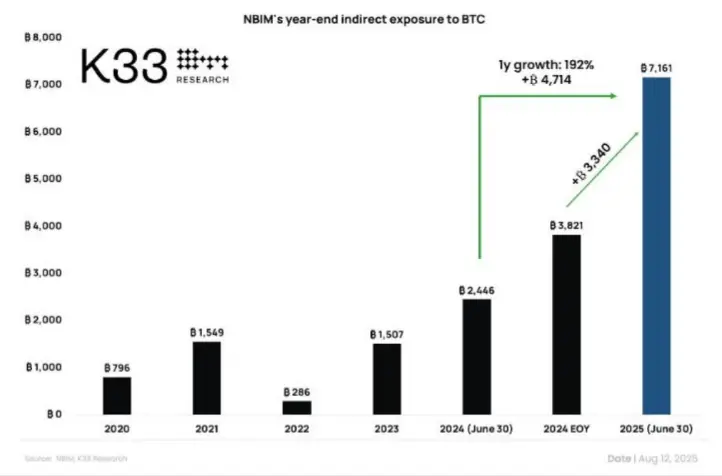

Norway's Sovereign Wealth Fund Now Indirectly Holds 7,161 BTC — A Quiet Accumulation Strategy?

Norway’s NBIM — the world’s largest sovereign wealth fund — has ramped up its indirect Bitcoin exposure by 192% YoY, reaching 7,161 BTC (~$844M) as of June 30, 2025. That’s an addition of 3,340 BTC in just six months.

This exposure is not from holding BTC directly, but through equity positions in public companies with large Bitcoin reserves.

Breakdown of key holdings:

+ MicroStrategy: +3,005.5 BTC

+ Marathon Digital: +216.4 BTC

+ Block: +85.1 BTC

+ Coinbase: +57.2 BTC

+ Metaplanet: +50.8 BTC

Smaller

Norway’s NBIM — the world’s largest sovereign wealth fund — has ramped up its indirect Bitcoin exposure by 192% YoY, reaching 7,161 BTC (~$844M) as of June 30, 2025. That’s an addition of 3,340 BTC in just six months.

This exposure is not from holding BTC directly, but through equity positions in public companies with large Bitcoin reserves.

Breakdown of key holdings:

+ MicroStrategy: +3,005.5 BTC

+ Marathon Digital: +216.4 BTC

+ Block: +85.1 BTC

+ Coinbase: +57.2 BTC

+ Metaplanet: +50.8 BTC

Smaller

- Reward

- like

- Comment

- Repost

- Share