Layer3Dreamer

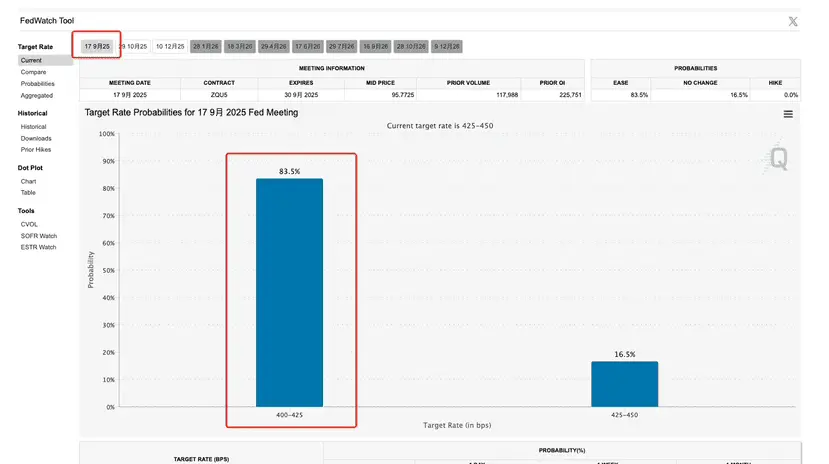

Recently, Goldman Sachs released an eye-catching report predicting that the Fed may begin implementing significant monetary policy adjustments as early as September this year. According to the report, the Fed is likely to carry out three consecutive rate cuts within the year, each by 25 basis points. Notably, Goldman Sachs also put forward an interesting hypothesis: if the unemployment rate data to be announced next month continues to rise, the rate cut in September could be directly expanded to 50 basis points.

This prediction has sparked widespread attention in the market. Although inflation

View OriginalThis prediction has sparked widespread attention in the market. Although inflation