Good morning friends. May it be a fruitful day.

View OriginalTeknikçiHoca

No content yet

TeknikçiHoca

Today I will share a classic formation example.

Long stops below the long-term dip in $XCN are being triggered, and the price is moving upwards again.

For two days, although the price has been trying to rise, they have pressed down on it. However, there is still an exit from the green zone and a serious demand.

Above, there are swing points that are close to each other. There are short stops here. When triggered, it can lead to rapid movements in succession.

Long stops below the long-term dip in $XCN are being triggered, and the price is moving upwards again.

For two days, although the price has been trying to rise, they have pressed down on it. However, there is still an exit from the green zone and a serious demand.

Above, there are swing points that are close to each other. There are short stops here. When triggered, it can lead to rapid movements in succession.

XCN-4.75%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

When I sat down in front of the screen, I had the opportunity to examine the movements in the market. Overall, I don't think there is a situation that will skyrocket. However, there may be opportunities in extreme movements on an individual basis.

$CTSI has perhaps experienced such a strong surge today for the first time in years. When long horizontal accumulation zones are broken, the rise is usually not limited to just one day. I don't know if this is an exit pump, but I expect the movement to continue.

I decided to try it as a high-risk and very short-term trade. You should do good risk ass

View Original$CTSI has perhaps experienced such a strong surge today for the first time in years. When long horizontal accumulation zones are broken, the rise is usually not limited to just one day. I don't know if this is an exit pump, but I expect the movement to continue.

I decided to try it as a high-risk and very short-term trade. You should do good risk ass

- Reward

- like

- Comment

- Repost

- Share

How are you friends? How is everything?

View Original- Reward

- like

- 1

- Repost

- Share

GateUser-b9dc2998 :

:

If you want to make money, buy nfts from the link in my profile and put them up for sale now... 😎As it drops into the 30-40 dominance band, the bull trend will continue until crypto and bitcoin reach their peaks on Google trends.

BTC-1.31%

- Reward

- like

- Comment

- Repost

- Share

$GORK had experienced a significant get dumped after seeing a 100M$ mcap when it first launched. There has been an accumulation pattern at the dip for months.

There has been a new activity lately. Volume and momentum are increasing.

It hasn't broken away from the horizontal zone yet. However, I think that when it does break away, it will rise very quickly along with the overall positivity.

A medium-term forecast. High risk and return. You should assess your own risk accordingly.

There has been a new activity lately. Volume and momentum are increasing.

It hasn't broken away from the horizontal zone yet. However, I think that when it does break away, it will rise very quickly along with the overall positivity.

A medium-term forecast. High risk and return. You should assess your own risk accordingly.

GORK-1.84%

- Reward

- 1

- 2

- Repost

- Share

GateUser-0be4557e :

:

Just go for it💪View More

I pay special attention to anomalies in my market scans. Because the best money is made here.

$VELVET had jumped above the resistance it had tested several times and then had faced selling.

In this form, it looks like a standard bull trap. However, the strength of the momentum suggests that the price should continue.

Positions on the futures side are not yet resolved. I decided to attempt a buy from here. If it breaks above the resistance level and stays there, it could have great potential.

$VELVET had jumped above the resistance it had tested several times and then had faced selling.

In this form, it looks like a standard bull trap. However, the strength of the momentum suggests that the price should continue.

Positions on the futures side are not yet resolved. I decided to attempt a buy from here. If it breaks above the resistance level and stays there, it could have great potential.

VELVET17.4%

- Reward

- like

- 1

- Repost

- Share

LiGuangtou :

:

More or empty- Reward

- like

- 1

- Repost

- Share

GateUser-33dfc4b1 :

:

Just go for it💪- Reward

- 2

- Comment

- Repost

- Share

There are many followers asking about short-term trades.

I notice esports in high-risk/high-return targeted short-term trades. The bullish trend has been continuing for weeks.

There is a large bowl formation with a resistance breakout and then a re-test appearance.

Honestly, I don't have detailed information about the project. From a TA perspective, this is a high-risk transaction that catches my attention.

View OriginalI notice esports in high-risk/high-return targeted short-term trades. The bullish trend has been continuing for weeks.

There is a large bowl formation with a resistance breakout and then a re-test appearance.

Honestly, I don't have detailed information about the project. From a TA perspective, this is a high-risk transaction that catches my attention.

- Reward

- like

- Comment

- Repost

- Share

I decided to take another look at the market since the plummets had paused.

The first thing that caught my attention was $MAGIC. There is an attempt to move. Volume is on the rise. It is close to the resistance area that it has tried to break a few times.

It is likely to go to fill the nested bowls.

The first thing that caught my attention was $MAGIC. There is an attempt to move. Volume is on the rise. It is close to the resistance area that it has tried to break a few times.

It is likely to go to fill the nested bowls.

MAGIC0.99%

- Reward

- like

- Comment

- Repost

- Share

Regardless of the general state of the market, what matters is the performance of what we have.

View Original- Reward

- like

- Comment

- Repost

- Share

Good morning friends.

When I examined the data that came in today, I saw that there could be an opportunity in $PUFFER in the medium to long term.

There has been a horizontal accumulation pattern at the bottom for months, and a strong momentum is forming.

Even if it is not immediate, I expect it to fill the large bowl during the ascent from this region over time.

When I examined the data that came in today, I saw that there could be an opportunity in $PUFFER in the medium to long term.

There has been a horizontal accumulation pattern at the bottom for months, and a strong momentum is forming.

Even if it is not immediate, I expect it to fill the large bowl during the ascent from this region over time.

PUFFER-2.25%

- Reward

- 1

- 1

- Repost

- Share

GateUser-88e53a61 :

:

Stop dreaming.$ALT has been in accumulation mode at the dip for months.

A movie is playing here.

It hasn't broken yet, but the momentum is quite strong.

A movie is playing here.

It hasn't broken yet, but the momentum is quite strong.

ALT-1.2%

- Reward

- like

- Comment

- Repost

- Share

Have a good Sunday, everyone.

$VINE caught my attention in the latest scans. They've made beautiful bowls. There is currently no selling pressure. Therefore, I expect the movement to continue.

It is likely to go as far as the bowl size with the break.

$VINE caught my attention in the latest scans. They've made beautiful bowls. There is currently no selling pressure. Therefore, I expect the movement to continue.

It is likely to go as far as the bowl size with the break.

VINE2.57%

- Reward

- like

- Comment

- Repost

- Share

$SLF is heating up.

At some point, we may see a nice breakout along with the resistance break.

It can happen and end within 1-2 days.

At some point, we may see a nice breakout along with the resistance break.

It can happen and end within 1-2 days.

SLF-0.14%

- Reward

- like

- 1

- Repost

- Share

NakreS :

:

What is the fate of this slf, can it reach a good place?There are some noteworthy developments from RWA Inc this week:

The private investor platform is coming online.

The trading section is becoming active.

4 corporate clients integrated

The automatic buyback mechanism is starting.

3 early investment pools are closing

As of July 25, it is entering its 8th month. This means that 80% of the $RWAINC supply held by early-stage foreign investors will be fully unlocked.

The steps that will take place this week will be effective for the followers moving forward.

View OriginalThe private investor platform is coming online.

The trading section is becoming active.

4 corporate clients integrated

The automatic buyback mechanism is starting.

3 early investment pools are closing

As of July 25, it is entering its 8th month. This means that 80% of the $RWAINC supply held by early-stage foreign investors will be fully unlocked.

The steps that will take place this week will be effective for the followers moving forward.

- Reward

- 2

- 1

- Repost

- Share

GateUser-7f498bb6 :

:

👀👀💣💣🚀🚀People have become resilient due to the losses they have experienced.

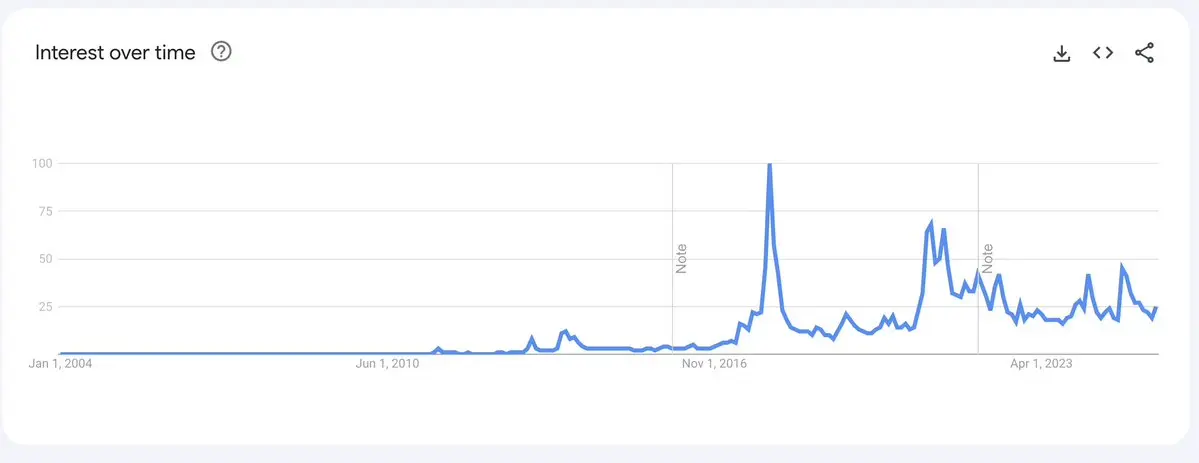

Despite reaching new peaks, the keyword bitcoin still sees quite low interest in Google trends.

When we reach the peak of the cycle, this interest will also peak.

We are still at the beginning of the bullish cycle for altcoins.

Despite reaching new peaks, the keyword bitcoin still sees quite low interest in Google trends.

When we reach the peak of the cycle, this interest will also peak.

We are still at the beginning of the bullish cycle for altcoins.

BTC-1.31%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

I have taken what I could from the current transactions and have converted to cash to reassess the market.

I think some of what I have shared recently will continue to walk, but it would be better for me to wait for the market to stabilize a bit.

I think some of what I have shared recently will continue to walk, but it would be better for me to wait for the market to stabilize a bit.

ALD-13.93%

- Reward

- like

- Comment

- Repost

- Share